What is an enthusiastic Amortization Plan?

Amortizing finance function level commission number across the longevity of brand new loan, but with varying dimensions of focus and principal making up for each and every payment. A traditional home loan try a prime example of instance financing.

That loan amortization agenda stands for the whole dining table away from unexpected financing money, indicating the level of principal and you can focus that comprise for each and every top percentage through to the financing is paid back at the conclusion of its name. Early in brand new plan, most for every payment would go to attention; afterwards on the agenda, many for every fee actually starts to shelter the latest loan’s left dominant.

Secret Takeaways

- A loan amortization agenda is actually a desk that presents each periodic financing payment that is due, typically monthly, to own top-fee finance.

- This new agenda reduces how much of each percentage try appointed on desire rather than the main.

- Mortgage amortization tables will help a borrower monitor just what they are obligated to pay just in case commission flow from, along with prediction the fresh outstanding equilibrium otherwise focus any kind of time part of the fresh period.

- Financing amortization dates are often seen whenever writing about repayment fund that have identified rewards dates at that time the loan is actually applied for.

- Types of amortizing funds include mortgage loans and car and truck loans.

Wisdom an enthusiastic Amortization Schedule

If you are taking out fully home financing otherwise car loan, the financial should provide you which have a copy of one’s financing amortization agenda so you can look for at a glance precisely what the financing will cost and just how the principal and attention could be broken down more the existence.

Inside the financing amortization schedule, this new portion of for each and every payment that visits attract lowers a piece with each percentage and the payment one visits principal expands. Just take, instance, financing amortization schedule for an excellent $165,100000, 30-seasons fixed-rates financial having a 4.5% rate of interest:

Amortization schedules can be designed centered on your loan plus individual issues. With more excellent amortization calculators, including the templates there are from inside the Do well you could examine just how and then make expidited costs is also speed your amortization. If the such as, you are pregnant an inheritance, or you rating a flat yearly incentive, you should use these tools evaluate just how implementing you to definitely windfall towards financial obligation can affect your loan’s readiness time along with your interest costs over the life of the mortgage.

Together with mortgages, auto loans and private money are also amortizing for an expression invest advance, in the a fixed interest rate which have my company an appartment payment per month. New terms and conditions are different with regards to the investment. Very antique lenders was fifteen- otherwise 29-12 months terminology. Vehicles residents have a tendency to get a car loan which can be reduced more than 5 years otherwise reduced. For personal money, 36 months is a common name.

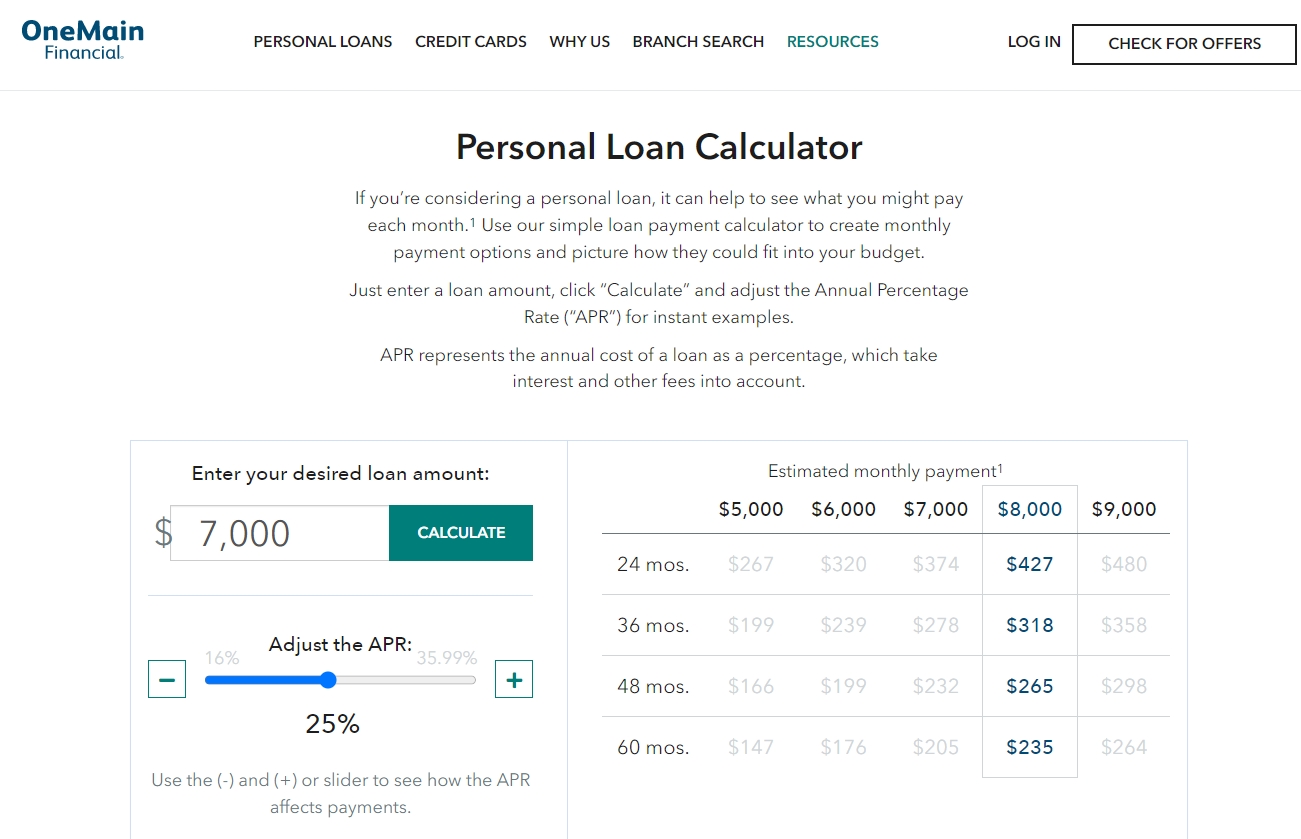

If you are searching to take out a loan, besides playing with financing amortization schedule, you may have fun with an enthusiastic amortization calculator so you’re able to guess the full financial will set you back considering your unique financing.

Algorithms Utilized in Amortization Schedules

Individuals and you can lenders play with amortization times to own payment money with payoff times that will be recognized at that time the borrowed funds try removed, like a home loan otherwise a car loan. There are specific algorithms which can be used to establish financing amortization schedule. These types of formulas tends to be integrated into the application you are having fun with, or you ortization plan from scratch.

Once you know the definition of off that loan and complete unexpected commission matter, you will find a way to determine financing amortization schedule instead resorting to the utilization of an on-line amortization schedule or calculator. The latest algorithm to help you calculate brand new month-to-month dominating owed into an amortized mortgage can be as observe: