To purchase a home is among the biggest and most very important investments of a lot people previously build – and your credit history renders a big difference. If you’re considering this significant pick, insights your credit rating makes it possible to most readily useful navigate your options (and you can pressures) of one’s home mortgage industries.

Examining your credit rating can help you know if your feel the enough credit rating needed seriously to pick a house. After that you can take steps to switch they and you can possibly increase your odds of obtaining the financial you desire, for the terminology you can afford. That’s because credit history critiques have a life threatening affect your capability to acquire an interest rate and on the eye rates and you will terminology you are offered by lending people.

What’s good credit range?

Why don’t we start-off of the looking about the numbers of the borrowing from the bank score, that is a numerical representation of the total credit history just like the influenced by the three big credit agencies:

Each of these credit bureaus spends only the advice advertised so you’re able to their team to determine your rating. This can cause differences in the latest ratings claimed by the TransUnion, Equifax and you may Experian. Very credit history ratings fall in the range of 301 to help you 850, that have higher scores preferred by lenders about software to have individual borrowing from the bank.

On top of that, good FICO rating, that’s somebody’s credit score calculated with app from the Fair Isaac Business, is most commonly used by loan providers to decide their eligibility having mortgage loans or other financing. Which credit rating is determined by investigating economic study and you can researching one information along with other customers to generate a relative positions.

An excellent FICO Score anywhere between 740 and 850 tends to be considered to enter the very best that you sophisticated credit history variety so you’re able to buy property. If the get falls less than this top, however, you might still be eligible for certain mortgage ventures regarding the economic areas.

How is your credit score recommendations utilized when purchasing a house?

Lenders view a variety of factors in terms of your eligibility for mortgage arrangements. Probably the most essential of these are the after the:

A career and you will home record A good loans and continuing loans Quantity of their deposit The FICO Score from one or higher of credit reporting agencies

Their mortgage lender commonly think about the entire visualize when looking at the money you owe. The target is to slow down the exposure incurred to your mortgage to make sure you can afford new words and costs and the lender can also be recover the money.

Mortgages are for sale to a relatively number of borrowing score, generally there is no secret credit score to buy property. Buying a home having bad credit can be done having an enormous adequate advance payment, low a good personal debt and you may stable works and home histories.

Occasionally, however, it could be to your advantage to minimize the debt weight and also to alter your fico scores before trying to loan places Swink area shop for good home.

What exactly is good credit assortment for selecting property?

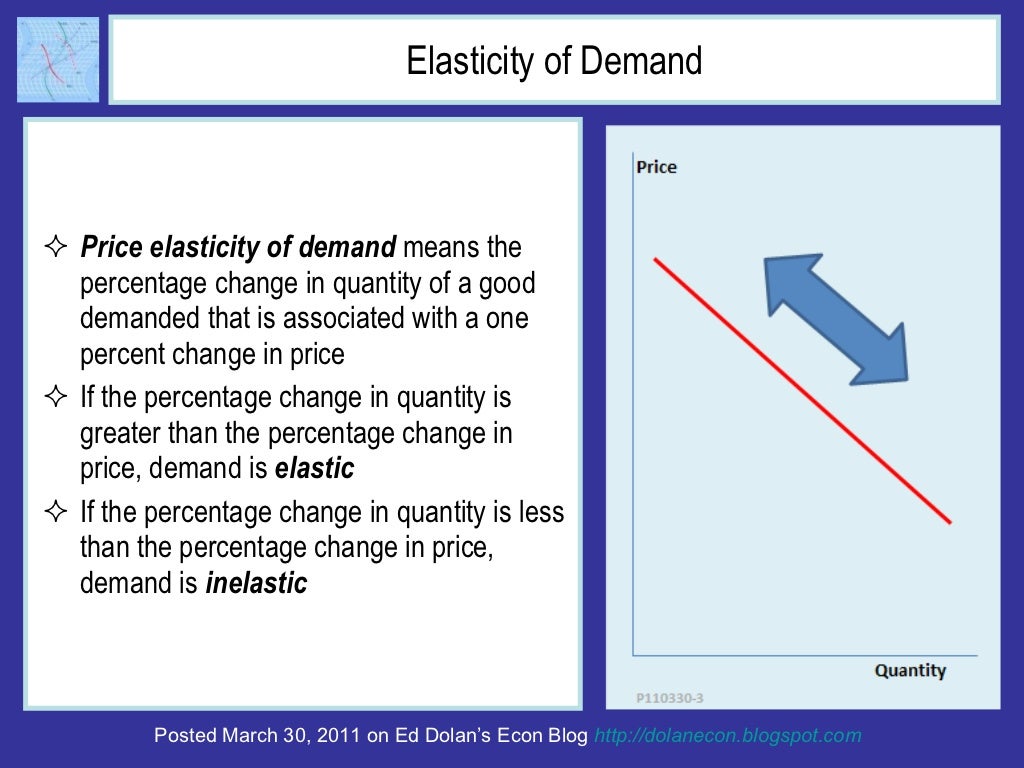

Should your credit rating range was anywhere between 740 and you can 850, you may possibly have the largest set of options and you will the absolute most attractive interest levels for the real estate loan. Very loan providers dictate financial rates by the credit history, it is therefore less inclined to reach low interest rates if the FICO ratings is actually lower than 740.

You may still be provided an interest rate with straight down results, nevertheless terms may not be since the beneficial. You might also become recognized to own a reduced mortgage amount than just the sum of where you to begin with applied.

This new Federal Houses Government (FHA) can also be an alternative to possess basic-date home buyers exactly who see specific conditions. If you’re wanting to know tips purchase property having crappy borrowing, a keen FHA mortgage will be the answer for your. Some of the number one requirements to have a keen FHA financial are the following:

You should offer a down payment with a minimum of step three.5 % of your own house’s really worth. You should be an appropriate resident of the You.S. that have a valid Personal Coverage number. Your debt-to-money proportion, and every a fantastic funds and your the new financial, need constantly feel 43 percent otherwise quicker. You really must have struggled to obtain the same manager for around 2 yrs otherwise enjoys a traditionally stable a position records so you can qualify.

Unless you fulfill such standards, but not, you might still have the ability to receive an interest rate. Particular credit people concentrate on providing financial solutions for folks with even worse credit scores; the latest terminology and you will rates offered of these arrangements, but not, tends to be as well negative for the majority home buyers.

A property to invest in calculator can sometimes present added facts towards the financial quantity and you will interest rates you’re considering from the lending people. Should your most recent credit history is restricting your capability to locate a mortgage, working to change your financial predicament to own a comparatively short time of your time can frequently improve probability of profits in the acquiring a mortgage you can afford.

The methods for which you is change your credit scores count into known reasons for men and women results. The experts at Experian possess some helpful suggestions based on how to raise your credit rating throughout the years:

Create your credit reports by the beginning accounts which is said so you can big credit bureaus, instance TransUnion, Equifax and you can Experian.

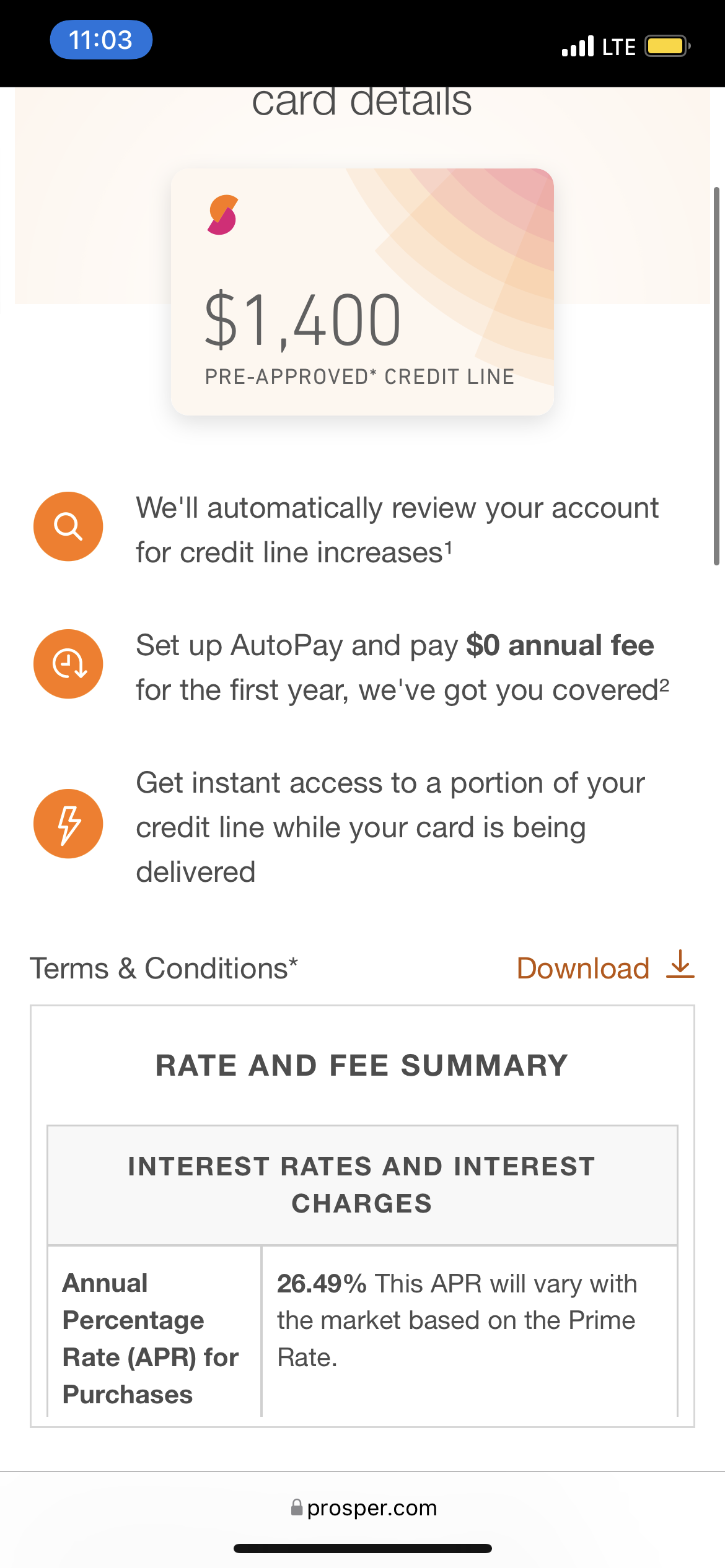

Reduce revolving membership stability and maintain your balance lowest cousin to the borrowing limit. For example, if for example the borrowing limit is $1000, keeping they less than $700 is excellent.

Through a good concerted work to switch your credit score, you could increase your odds of obtaining an interest rate. Increased credit history can also pave how for all the way down rates and much more advantageous terminology to you personally. This may features an optimistic affect their a lot of time-term financial predicament if you are making certain you love the key benefits of home ownership for a long time in the future.