New Nations doctor mortgage has several benefits to physicians, dentists and other doctors who would like to lay faster than just 20% down.

It is notorious one scientific and dental care schools in the Us are not inexpensive. Look completed of the from inside the 2021 implies that, typically, medical college students in the usa features about $241,600 from inside the beginner debt through to graduation. This is certainly no couple of bucks. This means an average medical school scholar owes alot more than just extremely youngsters which have up to six minutes as much financial obligation due.

As a result, without having any existence out-of official financing applications like the Places Lender medical practitioner loan, to invest in property might be challenging for the majority of physicians and dental practitioners for several years because they initiate its professions.

Having a property is extremely often a good investment about All of us. Buying your own home is a wonderful place to start. By firmly taking benefit of bank financing programs designed especially to individuals doing scientific residencies and complete-fledged physicians, you might probably rating ahead reduced and commence yourself for the the best legs once graduation.

Pros/Drawbacks out of Regions physician mortgages

Upon graduating of scientific or dental university, you could find you not only has tremendous student loans to pay-off however, less income, limited coupons, and you can less-than-mediocre credit score. On Nations d, your debt does not need to stop you from performing yourself. We have found a run down of benefits and drawbacks in so it mortgage system.

Available for customers, fellows, and doctors

Region’s home mortgage system can be found to help you a giant pond regarding candidates also customers, fellows, medical physicians, physicians of osteopathy, and doctors regarding dental drug. If you find yourself a medical expert just who falls in a single away from these categories, it may be best if you affect this d.

Include special borrowing from the bank allowances

In place of antique mortgage loans, with this specific financial program there isn’t any down-payment necessary with the a mortgage all the way to $750,000. Mortgages all the way to $1 million require only 5% off, giving a diminished costs solution. Additionally, certain deferred student loan money is omitted whenever Regions exercises your debt-to-income proportion, which will help whether your education loan loans are higher.

Straight down monthly installments

Some other glamorous ability on the physician financial system is the fact that its not necessary private mortgage insurance coverage (PMI). PMI is sometimes called for whenever getting a conventional mortgage, and thus that it mortgage can lead to lower monthly premiums. This may add up to significant savings over the years.

Expedited closing

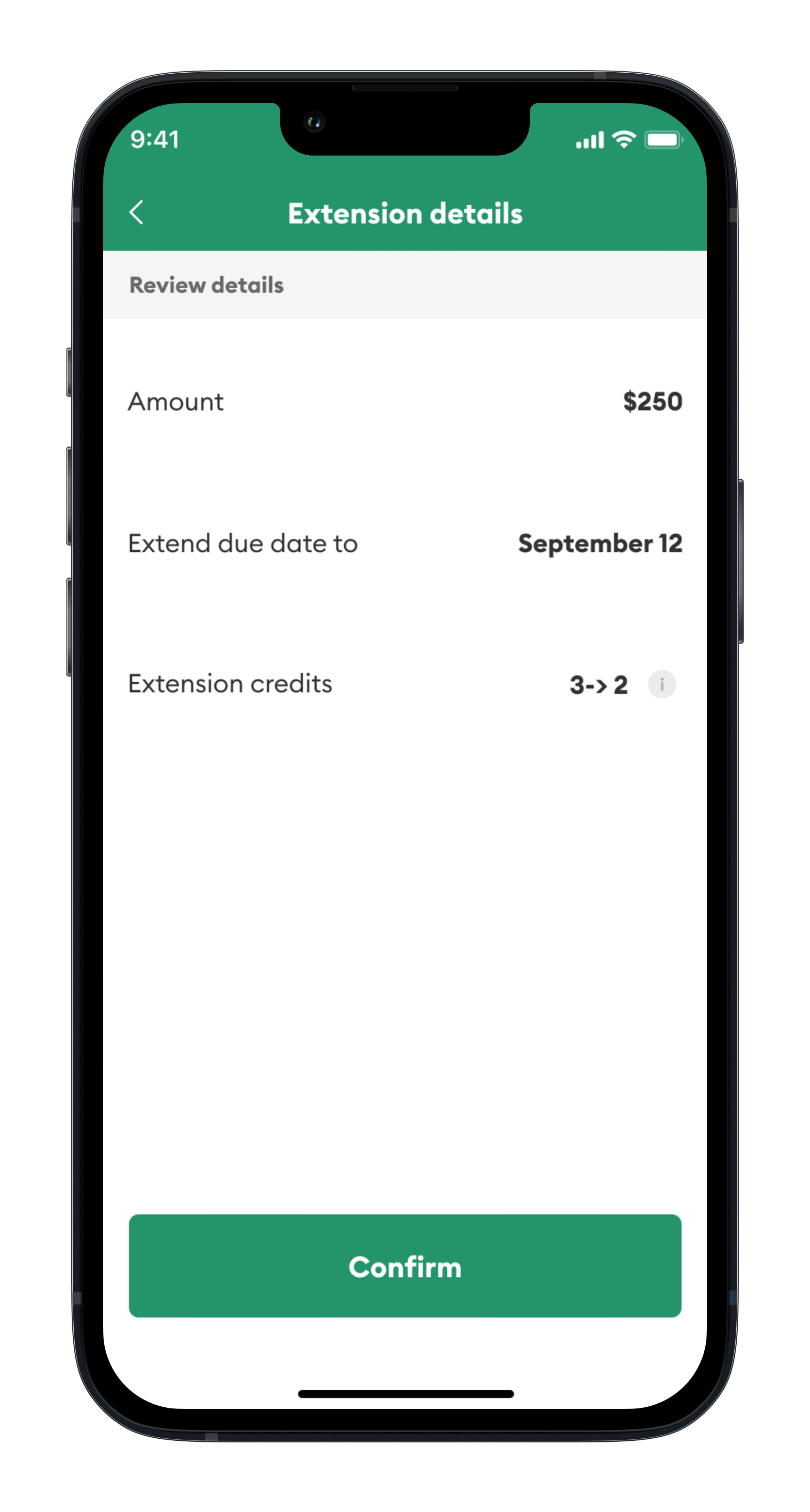

You might facilitate the fresh new closing of the loan before starting their employment, and you will track the advances. You can do this without difficulty from the uploading your articles via the Regions’ on the web Loan application Status Site. It isn’t difficult and you will user friendly to make use of. The lender has actually invested loads of info in aiding medical pros from the property processes.

No construction funds

Whenever you are trying to get home financing to construct the residence on the soil up, you will need to find other lenders. Which certified mortgage simply discusses current residential property and you will cannot connect with build funds, definition you’ll not be able to get a casing doctor household financing from underwriters.

Restricted access

Some other downside to Regions’ d would be the fact that it home loan product is limited in some states, definition the application is not nationwide. For folks who browse the disclosures, you will notice that the mortgage system will come in AL, AR, Florida, GA, IL, From inside the, IA, KY, Los angeles, MS, MO, NC, Sc, TN, and you may Colorado. Should you decide into way of life and working in other places, you will have to take a look at other choices.

The possibility of trying out continuously financial obligation

Delivering home financing for the good priount off risk. Have a tendency to, the worth https://simplycashadvance.net/loans/single-payment-loans/ of a home goes up in the long run but history shows it isn’t really the way it is. Thanks to this, you need to be mindful throughout the when and where your desire buy a property.

In case your household decreases in the really worth while you are nevertheless expenses it off, you could be obligated to spend the money for financial tens of thousands off bucks or maybe more in the event you to sell in this big date.

Also, by using a lot more of your readily available cash to own settlement costs and you can shorter getting a down payment (thanks to the doc financing), you will be less sensitive to closing costs as a whole and unknowingly save money money. Focus on the new amounts that have a calculator to ensure that you are at ease with the complete economic package (i.e. brand new settlement costs, fees words, an such like.).

How to incorporate

To try to get this mortgage program, check out the Regions’ D web page on line. Click the Query Now key and publish a message. This will include:

- Your identity

- The town in which you intend to purchase or refinance a good house

- A state

- Their get in touch with phone number

When making an application for the loan, you will need to render other standard recommendations on the financing officer. This consists of:

- A deal page for the house/fellowship

- Latest pay stubs

- Taxation statements off the past several years

- W-2 forms on last 2 yrs while you are working

- Information regarding your a great obligations

Trying to get an excellent Regions’ doctor’s mortgage will be recommended, dependent on your unique finances or any other appropriate factors. Places has the benefit of aggressive down-payment and financing wide variety and provide your options for fixed rates or variable interest finance.

As stated a lot more than, to purchase a home constantly incurs a certain amount of risk. By making use of to own an excellent doctor’s home loan you can potentially stand to get more due to all the way down monthly premiums while the chance to very own a house without the need to also provide a down payment.

For those who have questions relating to the qualifications (age.grams. whenever you are worry about-employed), we recommend that you have made pre-approved first and come up with also provides to your NMLS houses.

Joshua Holt is actually an authorized home loan maker (NMLS #2306824) and inventor out-of Biglaw Trader. Their mortgage possibilities will be based upon other areas out-of professional mortgages, specifically for solicitors, medical professionals and other high-earnings professionals. Prior to Biglaw Buyer, Josh skilled private collateral mergers & buy rules for 1 of your biggest law firms on country.